Consumer Packaged Goods: The State of CPG and 7 Top Brand Examples

Content

Consumer Packaged Goods, or CPGs for short, are defined as physical products that consumers buy on a routine basis. They’re most of the items you see when walking into a store – from durable goods to household products – and represent a large portion of the retail purchases we make in our everyday lives. Consumer goods are sold to customers directly for their own use; they are not meant for further manufacture or resale. The majority of consumer items are either sold online or on shop shelves. However, consumers do not take online services for the sensitive product line. Toilet paper, meat, drinks, cigarettes, cosmetics, and home cleansers are all subject to the CPG label.

No they are years. That is what every corporation hedges with 1-2 year contracts (typically 18 months). I know this as i did this for one of the worlds largest CPG companies for 3 years

— 2sexy4yourtweet (@2sexy4urtweet) September 29, 2022

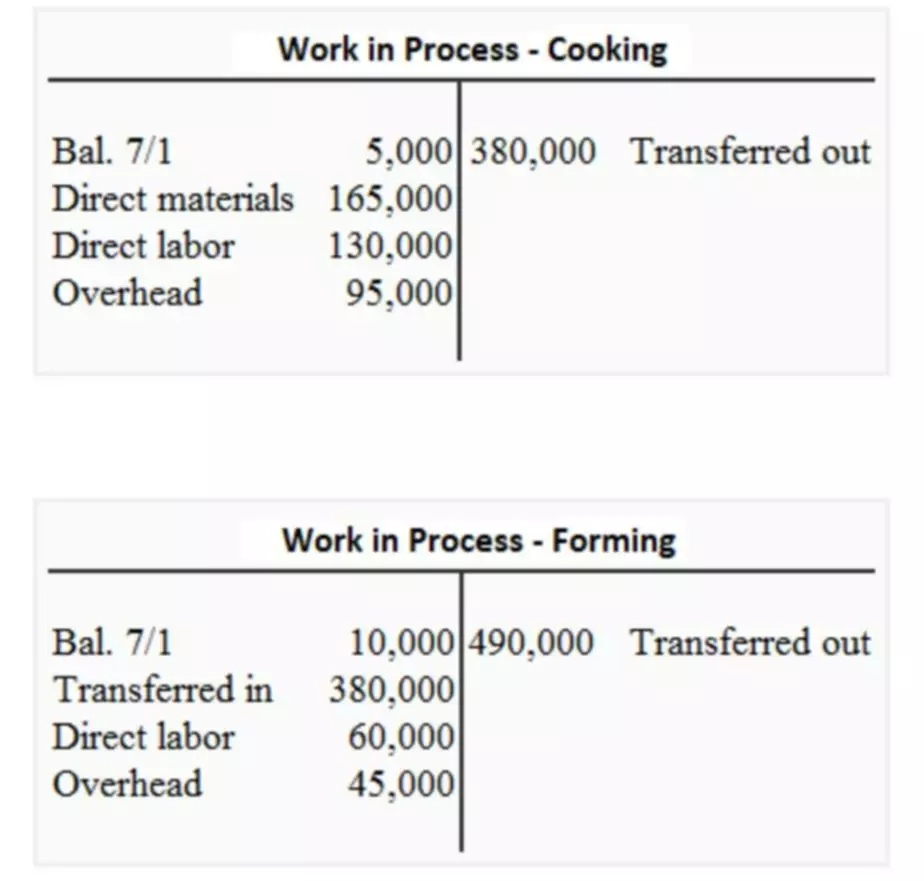

Manufacturing, distribution, brand creation, and retail sale of nondurable items are all included in the CPG industry. The pandemic has accelerated the shift to online and omnichannel shopping for CPG customers – and this behavior cpg accounting is here to stay. Consumer goods companies need to provide your own seamless omnichannel experiences direct to consumers by investing in e-commerce, data management, marketing, and omnichannel fulfillment solutions now.

How can CPG manufacturers respond?

Further, customers have access to more brand information than ever before. A simple search can tell them which CPG companies align with their values — for example, whether a makeup brand manufactures its products ethically or sustainably. Collect consumer feedback across multiple channels to identify opportunities to increase revenue, loyalty, and footfall with our experience management software.

- While those we observed last year are equally relevant for 2022, the differentiator is consumer behavior is evolving faster than ever.

- Established brands are likely to benefit at the expense of the startups that were gaining share before the crisis.

- Leveraging this type of data transparency enhances customer experience , driving higher engagement, loyalty and growth.

- Meanwhile, there’s information from manufacturing plants, supply chain partners, and a plethora of data from retailers about everything from merchandising to product returns.

- Coke is not just competing against Pepsi, but against Walmart’s Sam’s Cola.

It then sells those products to retailers, who sell them to the end consumer. The goal is to sell as many products, to as many consumers as possible. Today, CPG companies succeed by generating leverage over retailers by offering a variety of goods through horizontal integration. Conversely, retailers are vertically integrating, and offering their own private label goods to compete with CPG companies.

Challenges for Consumer Goods Companies

There is no doubt that the consumer packaged goods industry is highly competitive. When discussing the consumer packaged goods industry, it’s worth also mentioning FMCG, its definition and how it relates to the latter.

Drive superior business outcomes with speed and confidence using a cloud-native SaaS solution. Download the eBook now to learn how AI/ML can help your CPG company can act with the agility of a start-up. Moweb is now able to pass survey opportunities and updates to respondents in under one minute, an improvement of more than 200%. If you’re considering a new customer segment or market, you might send surveys to a representative sample.Use a sample marketplaceto access these samples quickly and affordably. Learn how to incorporate a sustainable philosophy into your overall business and technology implementations with insight from SAP and Oxford Economics. “Little mistakes can’t slip in any more. WebCenter makes layout checking faster and more efficient. If something goes wrong in the workflow, we always know exactly what went wrong. In the paper era, too much simply disappeared.” Without a centralized location for the team’s projects, approvals, artwork, etc., visibility of the entire labeling and artwork workflow is lost, leading to increased packaging error rates and recalls.

For a marketer:

Consumer packaged goods is an industry term for merchandise that customers use up and replace on a frequent basis. Examples of consumer packaged goods include food, beverages, cosmetics, and cleaning products. CPGs can be contrasted with durable goods , an industry term for merchandise that is not consumed or destroyed in use and is generally not replaced until the merchandise experiences a problem. Examples of durable goods include appliances, furniture, and automobiles. Supply shocks, rising costs, disruptions, and labor shortages in supply chains show no signs of abating. Modernizing the supply chain through IoT sensors, blockchain, integrated data, real-time analytics, and open partner networks can help offset these challenges and provide better visibility into risks. That’s because their retail partners traditionally outright own the transactional data for customers who purchase CPGs’ products and don’t willingly share that invaluable shopper data back with those consumer goods organizations.

The combination of dynamic pricing and consumers’ ability to receive real-time price comparisons and notifications will squeeze margins. To deal with sustained uncertainty, companies will need to better manage how they anticipate and plan for fluctuations in demand. A robust demand-sensing capability will require enterprise-wide collaboration across the supply chain, finance, sales and marketing. By using a combination of consumer insights, COVID-19 scenarios and their own customer data, CPG firms can better predict and mobilize against changes to consumption, channel mix and product demand by ZIP code.

Mobility, Social Media and Location based services

Moreover, 43% of consumers say they will continue shopping for at least some of their groceries online post-pandemic. In fact, the CPG industry saw a massive uptick in sales when the COVID-19 pandemic hit—to the tune of $8.5 billion from March 7-21st, 2020, or a 35% jump in the number of people shopping online for consumer packaged goods. As a result, CPG inventory turns over quickly for retailers compared to other products without a shelf life (or one that’s much longer than, say, a tube of mascara or a jug of milk). In this post, we’re diving into all things CPG, from what CPG brands are to a list of the top consumer packaged goods companies in 2022 and more. Fortunately, with Byzzer’s reporting solutions, you can have all the data you need at your fingertips. Depending on your product line, you need to know how much to adapt to consumer needs and retailer sales capabilities. Byzzer provides breakdowns of all these attributes in easy-to-digest reports.

- Operations — including a global supply chain tailored to preempt raw material disruptions — can reduce the cost to serve.

- Nestlé owns household name brands such as Cheerios, Gerber, Perrier, Coffee-Mate, and KitKat.

- Let’s say that same manufacturer sells a million dollars worth of cat litter.

- All investments involve risk, including the possible loss of capital.